Updated March 9, 2021.

The Employer Retention Credit (ERC) hasn’t got very much attention compared to the renewal of the PPP program, but most camps can likely receive tens of thousands of dollars from this program.

Up until now, almost every camp has ignored the ERC program because the CARES act allowed you only to pick either PPP or ERC, not both. Pretty much every camp chose PPP and rightfully so. With the December stimulus bill, that all changed and the exclusion was lifted. Now anyone who got a PPP can claim the ERC too.

The impact is that most camps will be able to claim $5,000 per employee in 2020 (retroactively) and between $7,000-$28,000 per employee in 2021.

I’ll show you how to determine your eligibility for the credit, how to calculate your credit amount, and how to maximize it with your PPP Second Draw in 2021.

Am I eligible?

To be eligible to claim the ERC, your business must either:

be experiencing a more than nominal interruption to your business operations because of government order (10%)

OR, experiencing a quarterly reduction of gross receipts

I’m going to focus mostly on the gross receipts test because it’s more complicated to explain, far more generous if you can claim it, and not subjective.

Quickly, I’ll add these points about the “shut down” eligibility:

Cannot be self-imposed restrictions (ie. there is not prohibition against retreats, but you have self-determined it is not safe to host them)

Must be direct orders limiting your business, not blanket shelter-in-place or shutdown orders

Does not count if activities are still permitted but with social distancing restrictions; ie. you can still host events but attendees must be masked and distanced

The shutdown does not have to impact your profitability, just disrupt your operations

You will only be able to claim the credit for wages paid DURING the period of time the order is in effect - so if you take this path, you may have to cross-check against dates of bans on group gatherings and start and stop counting the credit. That’s a lot of work.

Examples where this may apply to you: a) your site is not allowed to be open for retreats or camp by local or state order, b) there is a ban on group gatherings that prevents you from holding parlor meetings and recruitment events, c)

However, most camps should be able to qualify by satisfying the reduction in gross receipts test. This is ideal, because:

All wages in the affected quarter(s) and a subsequent quarter apply

Clear and obvious thresholds for your board and accountants review

Don’t need to worry about specific dates; easiest to blanket claim with your payroll company

You get a “bonus quarter” to apply the credits. (The first quarter in which you *don’t* meet the gross receipts reduction test is still an eligible quarter). To wrap your head around that, the intention is that an employer doesn’t know that their business will recover in the upcoming quarter, so the idea is the credit incentivizes them to keep their employees on the payroll for the upcoming quarter. Even if you double your gross receipts, you still get to keep the credit.

What are gross receipts? You will want to review all of this with your accountant. But for now, think of it as all income, except PPP and tax credits. For camps that are using accrual accounting (most are), take note that:

(For non-profits) Multi-year pledges are booked for their full amount at the time of the pledge, unless there is a threshold restriction. (For example, a binding pledge to give $300,000 over 3 years on December 1, 2020 would be booked at a $300,000 gift on that date).

(For non-profits) Conditional pledges are only booked once the conditions have been satisfied. For example, you receive a 2:1 matching gift from your federation in January 2021. Your raise the full match on April 1, 2021. The revenue would be booked on April 1, 2021.

Payments for camp in 2021 (or retreats, etc) are not revenue until camp (or the event) begins. So all the camper payments will be applied as revenue in Q2 or Q3. When does camp tuition book? That’s up to your accountant. Typically, for camps using accrual accounting, you would book your tuition as revenue on the first day of the summer program that the child is enrolled in (or when the possibility of refunds / not providing the service has elapsed).

For camps using cash accounting, I suspect most qualify too as a large amount of camper tuition was prepaid (credited) in Q2 2020, depressing your cash receipts for the next year.

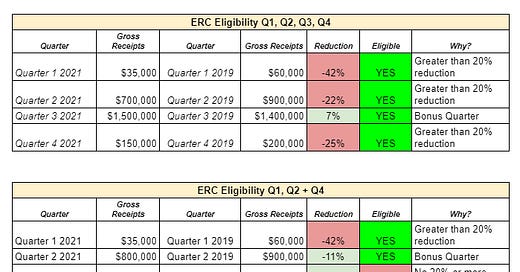

Here’s what eligibility looks like via the gross receipts test:

In 2020, beginning with the quarter in which you have a 50% reduction in gross receipts (compared to the same quarter in 2019) and continuing for every quarter until the quarter *after* your reduction is less than 20%. For most camps, the lack of camp in July and August will mean they easily pass the 50% reduction for Quarter 3. And then Quarter 4 is automatically eligible, regardless if you, for example, raised more money than in Quarter 4 of 2019.

In 2021, you need only have a 20% reduction in gross receipts compared to Q1 2019. If you qualify, then Q2 is automatically eligible.

For every quarter in 2021, you qualify if the current quarter OR the previous quarter’s gross receipts are down more than 20%.

Here it is in chart form:

OK, I’m eligible. How do I calculate my credit amount?

Now the fun part. This is actually fairly easy to calculate and claim. And your payroll company should do most of this work for you, as the credit will be included in quarterly payroll filings.

For 2020, the new legislation allows you to claim this credit retroactively.

50% of up to $10,000 in wages & health benefits per employee

=$5,000 per employee (THIS IS THE MAX FOR THE WHOLE YEAR)

Must be funds that are not applied towards PPP forgiveness

If your payroll and qualified expenses exceeded your PPP loan amount, you can apply ERC towards your excess payroll costs.

Talk to your payroll provider about filing a 941x to retroactively claim this credit. (The IRS has not yet given instructions on how to do this. So you’ll need to wait for your payroll provider or accountant to figure out how to do this).

Most camps had their PPP funds run out or the forgiveness period end by October. You’ll likely be able to get to the $5,000 max per employee by combining the period before your PPP started and after your PPP ended.

For 2021, the credit increases to 70% of employee wages & health benefits per employee, per quarter.

Up to $7,000 per employee for Quarter 1

Up to $7,000 per employee for Quarter 2

Here’s an example of how the 70% credit would play out in Quarter 1 of 2021 for a camp with 6 year-round employees.

(In this example, I’m assuming the camp pays employees 2x per month)

In this example, the camp gets a $39,235 credit if they maximize their credit over the whole quarter.

Now, you might start counting some of this payroll towards your PPP loan forgiveness once your PPP loan is funded. With the chart above, you can see that if your PPP loan is funded on February 16th and you stop taking the credit, you would lose about $10,000 in credits - but still claim almost $30,000 in credits.

If you expect your payroll and qualified expenses in your PPP to exceed your PPP loan amount, you can continue to claim your ERC on wages. This leads us to how to maximize the PPP and ERC funds together.

How to get the most out of PPP and ERC together

Maximizing these two programs will depend on several factors:

What is the funding date of your PPP loan? Your 24-week window begins as soon as the PPP funds land in your account. The later you delay the funding of your PPP loan, the more ERC you can claim and the more of your summer season that will fall in your 24 week window.

If you have a lot of covered expenses (facility modifications, rent/mortgage, utilities), you may find that you will have payroll costs that do not need to be applied towards forgiveness. If that’s the case, you’ll want to maximize the ERC on the payroll paid in Q1 and Q2 of 2021.

If you have an earlier summer season (camp starts beginning of June), more of your summer payroll will likely be able to be included.

Coordinate with your bank to get your loan application squared away and then “held” until you are ready to submit. You and your bank can track to see if the PPP funds are being depleted (it’s unlikely they will be or that they won’t be replenished if they are). Note that your application cannot be given an SBA number - as your forgiveness period automatically begins 10 days after the number is issued.

For many camps, March 15 to August 23, give or take 14 days, is the ideal 24-week forgiveness period.

Let’s look at this through the example of the above camp.

They received a PPP loan of $300,000

Their forgiveness period is March 1 to August 8th

The amount of their summer payroll that would be paid during the forgiveness period is $150,000 and the amount of year-round staff payroll is approximately $150,000. They also have $100,000 in other forgivable expenses.

The result is $400,000 in forgivable expenses, but just $300,000 in loans. That leaves about $100,000 in payroll expenses that could potentially be applied towards the ERC.

So now, let’s see how much this camp can qualify in ERC and PPP all together.

They apply the ERC towards all year-round staff wages in Quarter 1 until each employee reaches the $10k limit

They apply ERC towards all all year-round staff wages in Quarter 2 until each employee reaches the $10k limit

They apply a portion of seasonal staff wages towards ERC, after they ensure their payroll wages in the forgiven period meets the $200k they need to reach full forgiveness. To get to $200k, wages included will be all wages from July 1 to August 8 (when ERC does not apply), excess (after $10k) year-round staff wages from March 1-30th (Q1) and April 1 - June 30 (Q2).

Gaming out this interplay is challenging and time-consuming. Coming up, I’ll send an update with very detailed examples by pay period and an excel calculator you will be able to use to forecast your own situation.

Make sure to subscribe to the newsletter so that you get updated tools, explanations, and any notices about changes to PPP or ERC that will affect your camp.

OUTSTANDING!!!!

Hey Andrew- GREAT JOB with this article- it has helped countless camp professionals better grasp what needs to be done for their businesses. THANK YOU!